new mexico gross receipts tax due date

Receipts from gross amounts wagered. April 10 2020 May 10 2020.

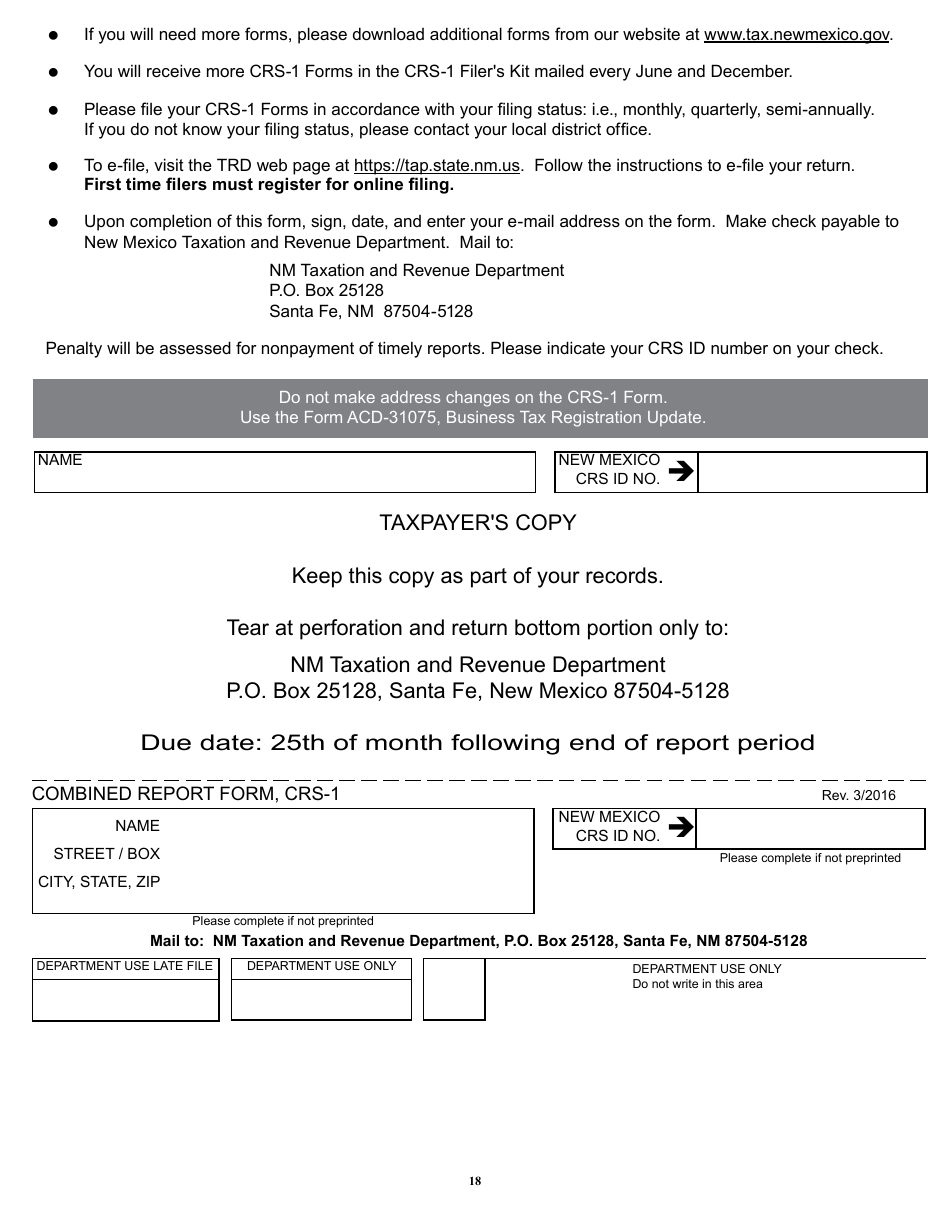

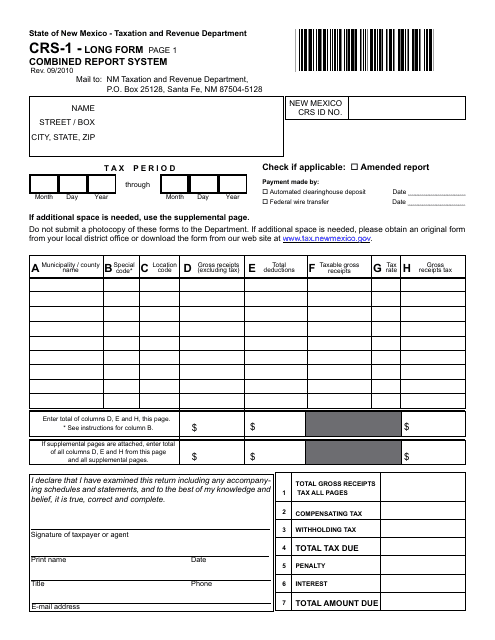

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report New Mexico Templateroller

Do not make address changes on the CRS-1 Form.

. Taxation and Revenue New Mexico. The New Mexico TRD requires all gross receipts tax filing to be completed by the 25th day of the month following the tax period. April 15 2020 July 15 2020.

Compensating tax withholding tax or gross receipts tax ex-cluding local option gross receipts tax due to the state of New Mexico. New Mexico sales tax returns are generally always due the 25th day of the month following the reporting period. Gross receipts tax and governmental gross receipts tax.

Personal Income Tax and Corporate Income Tax. Gross Receipts Tax and Marketplace Sales. Gross Receipts TaxCompensating Tax.

The Department assessed the Taxpayer because it. Any person required to pay any amount pursuant to Subsection D of Section 7-14-71 NMSA 1978 who fails to pay the amount by the date required is liable for penalty in an amount equal to the greater of five dollars 500 or two percent per month or any fraction of a month from the date the amount was due multiplied by the amount of tax due but. Filing your Gross Receipts Tax GRT online takes the stress out of work so you have time for more enjoyable things.

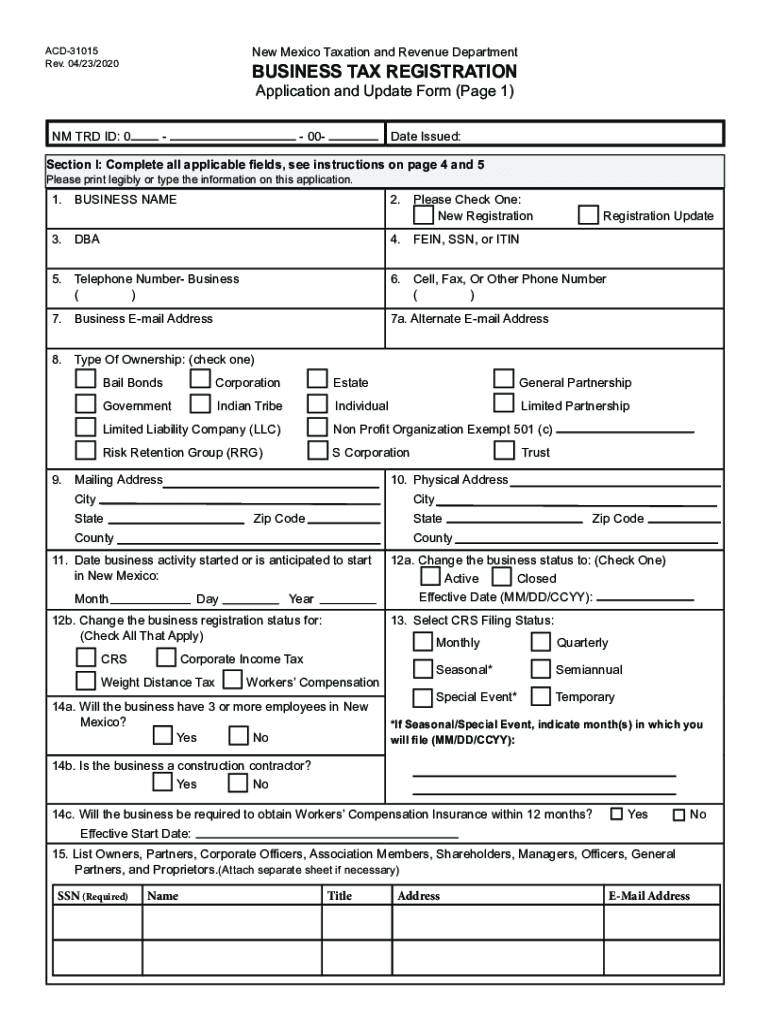

Generally a business collecting over 1000 in gross receipts tax each month will file monthly. This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return. Statutes Department Directives.

Latest News Hearing Thursday on new Gross Receipts Tax regulations. No taxpayer may claim an amount of approved basic credit for any reporting period that exceeds the sum of the taxpayers compensating tax withholding tax and gross recipts tax excluding local option gross. If the filing due date falls on a weekend or holiday sales tax is generally due the next business day.

March 25 2020 July 25 2020. 113Rev 0012021 New Mexico Taxation and Revenue Department 30300200 GROSS RECEIPTS TAX RETURN Signature of taxpayer or authorized agent Print Name Title Date I declare that I have examined this return including any accompanying schedules and statements and to the best of my knowledge and belief it is true. On the February 18 2019 the Department assessed the Taxpayer for corporate income tax for the 2014 through 2016 tax years.

6 also contained a second set of significant GRT changes that will go into effect on July 1 2021. As we previously reported the New Mexico Taxation and Revenue Department announced that withholding tax returns normally due on the 25th of March April May and June 2020 are due on July 25 2020. Taxation and Revenue New Mexico.

Use the Form ACD-31075 Business Tax Registration Update. Quarterly the 25th of the month following the end of the quarter if combined taxes for the quarter are less than 600 or an average of less than 200 per month in the quarter. The Taxpayer was in the business of producing and selling cannabis for medical use.

NM Taxation and Revenue Department PO. Under the new rules most New Mexico-based businesses pay the gross receipts tax rate in effect where their goods or the products of their services are delivered. Fill Print Go.

For monthly gross receipts tax filers gross receipts tax returns due August 25 will be the first gross receipts tax report using the new sourcing rules. We urge you to give it a try. Taxation and Revenue New Mexico.

Q2 Apr - Jun July 25. 6 New Mexicos own economic nexus threshold for the GRT took effect on July 12019. Q1 Jan - Mar April 25.

Gross Receipts Location Code and Tax Rate Map. 25th of month following end of report period. EY Payroll Newsflash Vol.

Out-of-state seller is in New Mexico is due to a loophole in the compensating tax. Section 7-9-41 - Exemption. 1-866-285-2996 3 GROSS RECEIPTS TAX RATE SCHEDULE Effective July 1 2019 through December 31 2019 Municipality or County Location Code Rate Municipality or County Location Code Rate.

More information on this standard is available in FYI-206. GRT - Filers Kit 3 wwwtaxnewmexicogov GROSS RECEIPTS AND COMPENSATING TAX RATE SCHEDULE Effective January 1 2022 through June 30 2022 Municipality or County Location Code Rate Municipality or County Location Code Rate Albuquerque 02-100 78750 Texico 05-302 75625 Edgewood Bernalillo 02-334 78750 Remainder of County 05-005 61250. Filing online is fast efficient easy and user friendly.

Section 7-9-40 - Exemption. The following receipts are exempt from the NM gross receipts tax sales tax. In New Mexico you will be required to file and remit sales tax either monthly quarterly or semiannually.

On May 15 2019 the Taxpayer submitted a formal protest. 4 rows Due Date Extended Due Date. Filing statuses for gross receipts tax and their due dates are.

Purses and jockey remuneration at New Mexico racetracks. March 25 2020 July 25 2020. Box 25128 Santa Fe New Mexico 87504-5128 Due date.

The tax is due on the 25th day of the month following the month of production unless otherwise authorized by the Department. Your New Mexico state gross receipt tax returns and payments are due on the 25 th of the. Property Tax Division.

Under gross receipts tax but are not due to special exemptions or deductions. Each Form TRD-41413 is due on or before the 25th of the month following the end of the tax period being reported. Employer withholding return deadlines for March-June extended to July 25 2020.

Section 7-9-411 - Exemption. As for payment E-pay is the quick and green way to. Current.

Businesses that do not have a physical presence in New Mexico including marketplace providers and sellers also are subject to Gross Receipts Tax if they have at least 100000 of taxable gross receipts in the previous calendar year. Due dates falling on a weekend or holiday are adjusted to the following business day. Below weve grouped New Mexico gross receipts tax filing due dates by filing frequency for your convenience.

GIS Data Disclaimer applies. PERIOD BEGINS PERIOD ENDS DUE DATE Call Center. Tear at perforation and return bottom portion only to.

Jockeys and trainers from race purses at New Mexico horse racetracks and receipts of racetracks from gross amounts wagered 7. Filings are due the 25 th day of the month following the reporting period unless the 25th falls on a weekend or federal holiday which would move to the next business day. New Mexico Top Organics.

Certain taxpayers are required to.

A Guide To New Mexico S Tax System New Mexico Voices For Children

How To File And Pay Sales Tax In New Mexico Taxvalet

How To File And Pay Sales Tax In New Mexico Taxvalet

Gross Receipts Location Code And Tax Rate Map Governments

Nm Trd Crs 1 2020 2022 Fill Out Tax Template Online Us Legal Forms

A Guide To New Mexico S Tax System New Mexico Voices For Children

New Mexico Sales Tax Small Business Guide Truic

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

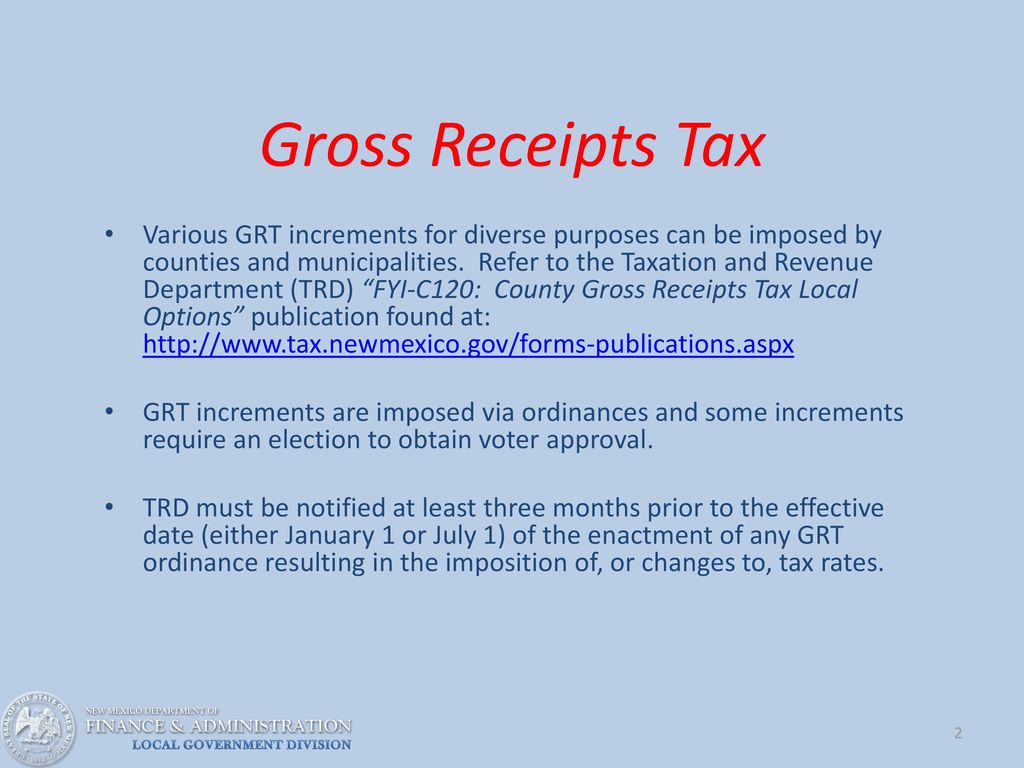

1 Crs 1 New Business Workshop 07 08 Taxes Are The Price We Pay For Civilization Justice Oliver Wendell Holmes Jr Ppt Download

Gross Receipts And Property Tax Ppt Download

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

How To File And Pay Sales Tax In New Mexico Taxvalet

What Is Gross Receipts Tax Overview States With Grt More

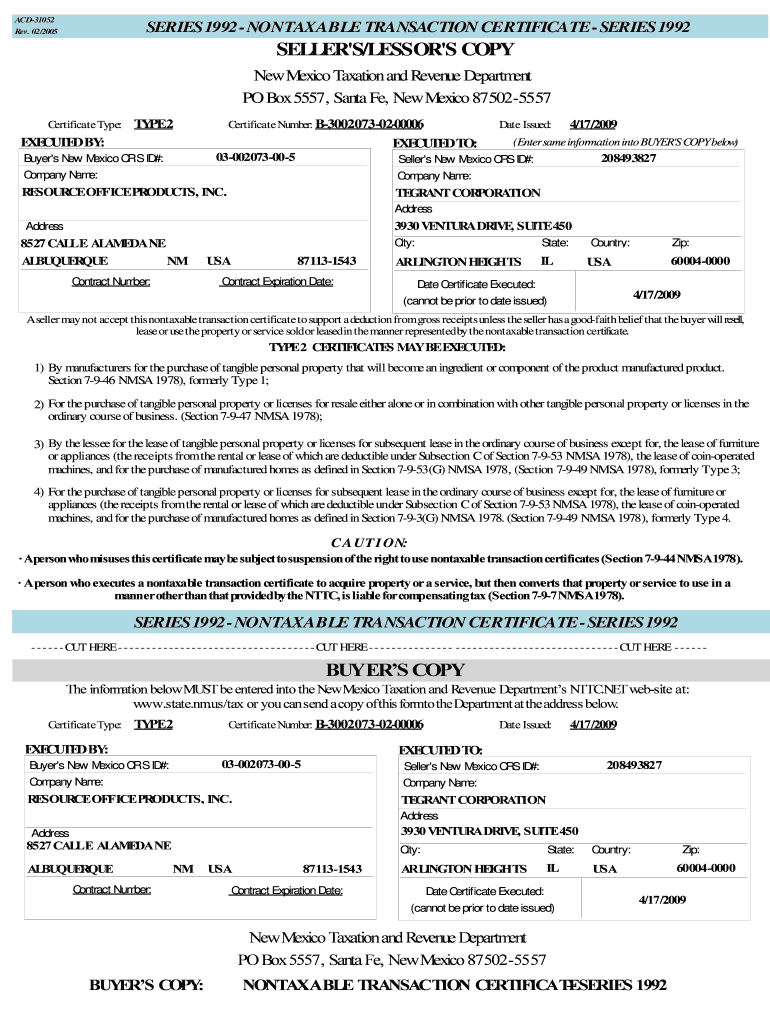

Nm Acd 31052 2005 2022 Fill Out Tax Template Online Us Legal Forms