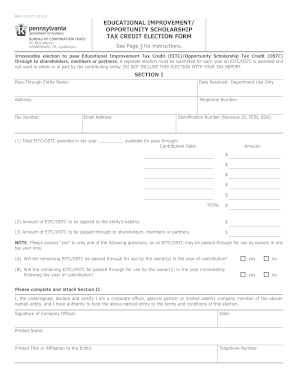

pa educational improvement tax credit application

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Educational Improvementopportunity Scholar Fill Out And Sign Printable Pdf Template Signnow

Choose from the locations below.

. Ad Access Tax Forms. Box 154 200 East Grove Street. In either case the maximum tax credit is 750000 per company.

A Scholarship Organization an. CategoriesProgram Guidelines Reference Sheets Reports and Documents File Type Download22087 Size68496 KB Create DateMay 3 2018 Last UpdatedApril 16 2019. Complete Edit or Print Tax Forms Instantly.

Credits are awarded to companies on a first-come first-served basis until the cap is reached. What your Business needs to do. The Educational Improvement Tax Credit Program EITC allows businesses to direct 90 of their PA state taxes to support education by funding scholarships at Erie Catholic School System.

Abington Heights Educational Improvement Organization Inc. Ad The Leading Online Publisher of Pennsylvania-specific Legal Documents. Apply for PA Tax credits available to eligible businesses contributing to scholarship organizations such as CEO America the Childrens Educational Opportunity Fund.

The Educational Improvement Tax Credit EITC Special Entity program and Opportunity Scholarship Tax Credit OSTC program. PA Educational Improvement Tax Credit EITC Program. Complete Edit or Print Tax Forms Instantly.

2 As an individual you may. What is the PA EITC. The total amount of tax.

1 As a business you may participate through the traditional program as described below. Ad Access Tax Forms. Qualified businesses can earn significant tax credits equal to 75.

Contact your tax professional to see if you qualify. The Commonwealth of Pennsylvania created the EITC Program to stimulate giving to innovative educational organizations. The Educational Improvement Tax Credit EITC Program provides credits to eligible businesses contributing to one of the following specific programs.

Get Access to the Largest Online Library of Legal Forms for Any State. Tips Services To Get More Back From Income Tax Credit. Ad Get Help maximize your income tax credit so you keep more of your hard earned money.

There are two ways to participate and you may qualify for both. The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational improvement. Clarks Summit PA 18411.

Tax credits may be applied.

Pennsylvania Educational Improvement Tax Credit Program Kimberton Waldorf School

Scholarships Central Christian Academy

Pennsylvania Educational Improvement Tax Credit Eitc Program Phoenixville Community Education Foundation

Pa Tax Credit The University School

The Pa Educational Improvement Tax Credit Program Library System Of Lancaster County

Educational Improvement Tax Credit Progam Jewish Federation Of The Lehigh Valley

A Decade Of Success Pennsylvania S Educational Improvement Tax Credit Commonwealth Foundation

Eitc News And Spe Information Central Pennsylvania Scholarship Fund

Keystone Central Foundation Seeks Businesses To Apply For State Tax Benefit Program The Record Online

Application Extension For Educational Improvement Tax Credit Eitc And Opportunity Tax Credit Otc Wilke Associates Cpas

Ways To Give The M S Hershey Foundation

Pennsylvania Approves 40m Budget Increase To Educational Improvement Tax Credit Program Blocs

Mastery Eitc Ostc Excellence No Excuses

Pennsylvania S Educational Improvement Tax Credit Eitc Ceo America

Educational Improvement Tax Credit

Pennsylvania Educational Improvement Tax Credit Eitc Program Phoenixville Community Education Foundation

Support Pa Tax Credit Programs Pa Private School Ssa

Prc Support Prc Through The Educational Improvement Tax Credit Eitc Program